Difference between revisions of "Tax Jurisdiction and Rate"

From Smartbilling

(→Tax Jurisdiction and Rate) |

|||

| Line 22: | Line 22: | ||

[[File:Change_the_tax_v5.png|950px]] | [[File:Change_the_tax_v5.png|950px]] | ||

| − | + | ||

| + | <center><u>[[Setting up the right content|Previous]]</u> | <u>[[Import Usage Functionality|Next]]</u></center> | ||

| + | <br> | ||

| + | ---- | ||

<u>[[SmartBilling Documentation Home Page|Home]]</u> | <u>[[SmartBilling Documentation Home Page|Home]]</u> | ||

<u>[[SmartBilling FAQ page|FAQ page]]</u> | <u>[[SmartBilling FAQ page|FAQ page]]</u> | ||

<u>[[SmartBilling 5.0 pages|SmartBilling 5.0]]</u> | <u>[[SmartBilling 5.0 pages|SmartBilling 5.0]]</u> | ||

Revision as of 10:24, 18 July 2017

Home FAQ page SmartBilling 5.0

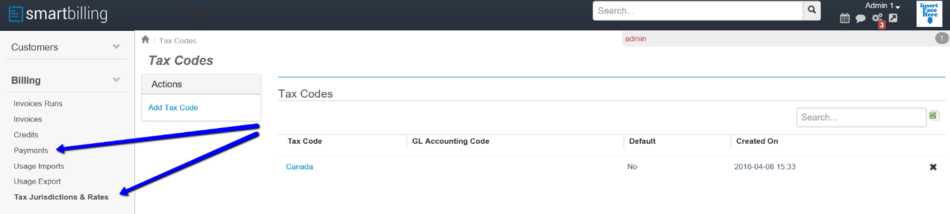

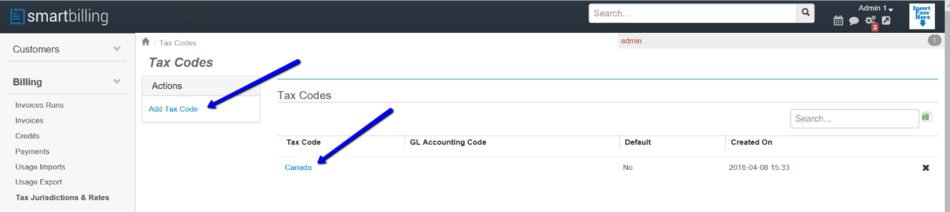

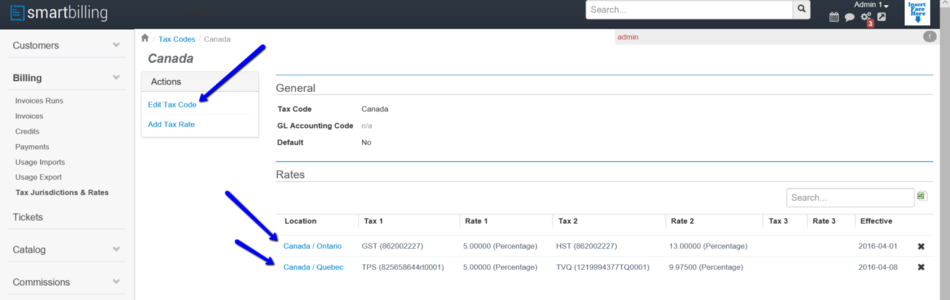

Tax Jurisdiction and Rate

The operator can create, revise and modify what the right calculation will be

Starting with the set up of the invoice, the right tax information is entered here.

So that the user can add, revise or change if needed: