Difference between revisions of "Payments"

(major revision to clean up mistakes and poor explanations.) |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 4: | Line 4: | ||

| − | == Payments == | + | == Payments (Cash Receipts and Adjustments) == |

| + | <br> | ||

| + | Smartbilling records payment and adjustment transactions as part of the Accounts Receivable and Collections processes. The [[Invoice]] process records Sales transactions that increase the Accounts Receivable, and the Payments process records deposits into the Bank Account, reducing the Accounts Receivable and increases the Bank Account balance. | ||

| + | <br> | ||

'''Payment methods''' | '''Payment methods''' | ||

<br> | <br> | ||

| − | Smartbilling | + | There are a number of different payment methods supported in Smartbilling. These include: |

| + | |||

| + | * payments from customers deposited into the company bank account, and reducing the amount owed by the customer to the company. These payments can take any of the following forms:<br> | ||

| + | ** Cash presented to the company offices; | ||

| + | ** Cheques sent to the company offices; | ||

| + | ** Bill payments issued by the customer through their bank and deposited into the company's bank account | ||

| + | ** E-mail and Wire Transfers from the customer's bank account that are deposited into the company's bank account; | ||

| + | ** Pre-authorized Automated Clearing House (ACH) or Direct Debit transactions that authorize the company to withdraw funds from the customer's bank account; | ||

| + | ** Credit card payments issued by the customer and received by the company; | ||

| + | ** Pre-authorized Credit Card payments that authorize the company to withdraw funds from the customer's credit card account. | ||

| + | <br> | ||

| + | The payment process can be partially or fully automated to reduce the manual workload required to record the payments. | ||

| Line 19: | Line 33: | ||

| − | '''Pre-authorized withdrawals''' | + | '''Pre-authorized (ACH or Direct Debit) withdrawals or payments (PAPs)''' |

| − | SmartBilling | + | SmartBilling users can create on-demand or scheduled requests for the application to prepare files containing Pre-authorized Withdrawal transactions for customers who have consented to pay with this method. Smartbilling will create a batch of transactions for the total amount of outstanding invoices that have become due as of the effective date for which the files are generated. These files must be manually uploaded to the Web portal belonging to the company's bank. |

If the Bank provides the operator with a confirmation file (usually available between 24-48 hours after the request file was submitted), it can be imported into SmartBilling so that the successful transactions can be updated in the Accounts Receivable for each customer. The operator can select whether or not to automatically apply payments against the oldest invoices. | If the Bank provides the operator with a confirmation file (usually available between 24-48 hours after the request file was submitted), it can be imported into SmartBilling so that the successful transactions can be updated in the Accounts Receivable for each customer. The operator can select whether or not to automatically apply payments against the oldest invoices. | ||

| − | If not, the Operator can manually enter the confirmation status of each payment from the bank statement, or force them all to be confirmed as successful and reverse any payments that are not deposited successfully as | + | If not, the Operator can manually enter the confirmation status of each payment from the bank statement, or force them all to be confirmed as successful and reverse any payments that are not deposited successfully as declined payment advice notifications are received from the bank. |

'''Payment imports''' | '''Payment imports''' | ||

| Line 31: | Line 45: | ||

A SmartBilling payments import template can be configured if a SmartBilling customer processes payments in a separate system and wishes to import payments data into SmartBilling to reconcile subscriber billing records. | A SmartBilling payments import template can be configured if a SmartBilling customer processes payments in a separate system and wishes to import payments data into SmartBilling to reconcile subscriber billing records. | ||

| − | '''Payment | + | '''Payment''' ''applications'' '''and''' ''allocations'' |

<br> | <br> | ||

| − | Without manual intervention, the system will apply payments to | + | Without manual intervention, the system will '''''apply''''' payments against outstanding invoices that are due or overdue within a customer account, giving priority to the oldest outstanding invoice with the largest amount due. |

| − | + | <br><br> | |

| − | + | In the case of payments made to a Parent Account, if automatic payment application is active, Smartbilling will search for the oldest unpaid invoices with the largest amounts due belonging to the parent account or any of the child accounts belonging to the parent account; it will '''''apply''''' all or part of the payment to invoices belonging to the parent account, or '''''allocate''''' (transfer) all or part of a payment to one or more of the child accounts and '''''apply''''' that allocation against the selected invoice. The process will continue with the next oldest invoices until the total amount of the payment has been applied. | |

| − | + | ||

| − | + | ||

<br> | <br> | ||

<br> | <br> | ||

''Manual allocation for parent-child accounts'' | ''Manual allocation for parent-child accounts'' | ||

<br> | <br> | ||

| − | A user can choose to manually allocate payment amounts between parent and child accounts. The Balance on the Payment transaction must be greater than zero. To allocate payments, the user must first delete the auto-allocated payments, then select the option to “Allocate Amount”. The user can then choose an allocation amount and choose which parent or child account to allocate the said amount to. | + | A user can choose to manually allocate payment amounts between parent and child accounts. The Balance on the Payment transaction must be greater than zero. To manually allocate payments, the user must first delete the auto-allocated payments, then select the option to “Allocate Amount”. The user can then choose an allocation amount and choose which parent or child account to allocate the said amount to. |

<br> | <br> | ||

<br> | <br> | ||

| Line 53: | Line 65: | ||

''Manually applying a payment to multiple invoices'' | ''Manually applying a payment to multiple invoices'' | ||

<br> | <br> | ||

| − | A user can choose to manually | + | A user can choose to manually apply payment amounts if a customer has multiple invoices due. The Balance on the Payment transaction must be greater than zero. To apply payments, the user must first delete one or more payment applications, then select the option to “Apply Amount.” The user can then enter the amount and choose which invoices against which the amount should be applied. |

| − | If the account is a parent or child account, the payment must first be allocated (either manually or automatically) | + | If the account is a parent or a child account, the payment must first be allocated (either manually or automatically) between the parent and child accounts. Then, the payment can be applied manually to multiple invoices. Ensure you know the exact invoices and the payment amounts to be applied to them. For example, to manually allocate a payment to a parent account and two child accounts, all of which have multiple invoices due: |

(1) Create a payment against the parent account for the full amount of the payment. The payment will auto-allocate, and the balance will be $0.00. | (1) Create a payment against the parent account for the full amount of the payment. The payment will auto-allocate, and the balance will be $0.00. | ||

| − | (2) In the Allocated Payments section, find | + | (2) In the Allocated Payments section, find the payment allocation and child account for which you want to manually select the invoices and amounts to be paid. |

(3) Click on the blue-highlighted “Balance” amount for this allocation (it should be $0.00). | (3) Click on the blue-highlighted “Balance” amount for this allocation (it should be $0.00). | ||

(4) On the following screen, click on the “X” icon to delete the allocation. | (4) On the following screen, click on the “X” icon to delete the allocation. | ||

| Line 64: | Line 76: | ||

<br> | <br> | ||

<br> | <br> | ||

| − | '''Payments for accounts that | + | '''Payments for accounts that exceed the total outstanding balance of the account''' |

<br> | <br> | ||

| − | If a customer’s payment is a larger amount than their total past due amount, | + | If a customer’s payment is a larger amount than their total past due amount, the remaining balance after the various payment applications and allocations will be recorded in the payment transaction as 'unapplied'. |

<br> | <br> | ||

<br> | <br> | ||

| Line 76: | Line 88: | ||

<br> | <br> | ||

| − | <center><u>[[Import Usage Functionality|Previous]]</u> | <u>[[Billing Operations|Next]]</u></center> | + | <center><u>[[Import Usage Functionality|Previous]]</u> | <u>[[Adjustments|Next page]]</u> | <u>[[Billing Operations|Next Topic]]</u> </center> |

<br> | <br> | ||

---- | ---- | ||

Latest revision as of 03:35, 1 February 2023

Home FAQ page SmartBilling 5.0

Payments (Cash Receipts and Adjustments)

Smartbilling records payment and adjustment transactions as part of the Accounts Receivable and Collections processes. The Invoice process records Sales transactions that increase the Accounts Receivable, and the Payments process records deposits into the Bank Account, reducing the Accounts Receivable and increases the Bank Account balance.

Payment methods

There are a number of different payment methods supported in Smartbilling. These include:

- payments from customers deposited into the company bank account, and reducing the amount owed by the customer to the company. These payments can take any of the following forms:

- Cash presented to the company offices;

- Cheques sent to the company offices;

- Bill payments issued by the customer through their bank and deposited into the company's bank account

- E-mail and Wire Transfers from the customer's bank account that are deposited into the company's bank account;

- Pre-authorized Automated Clearing House (ACH) or Direct Debit transactions that authorize the company to withdraw funds from the customer's bank account;

- Credit card payments issued by the customer and received by the company;

- Pre-authorized Credit Card payments that authorize the company to withdraw funds from the customer's credit card account.

The payment process can be partially or fully automated to reduce the manual workload required to record the payments.

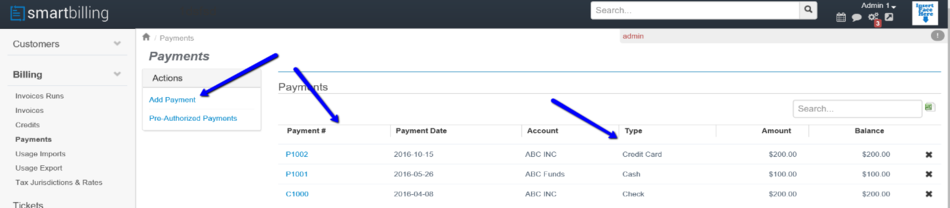

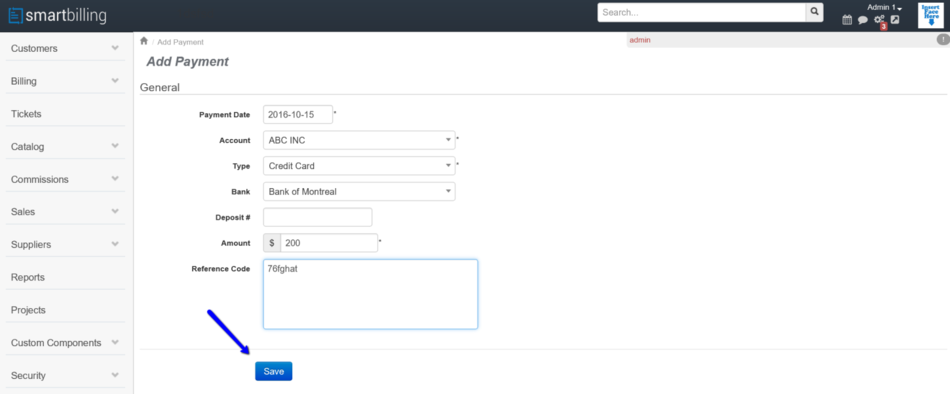

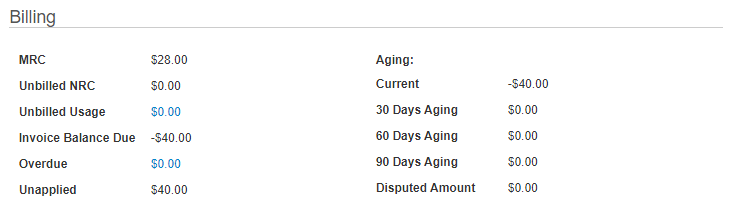

Below it is an example of a manual payment just loaded when clicked on save:

Pre-authorized (ACH or Direct Debit) withdrawals or payments (PAPs)

SmartBilling users can create on-demand or scheduled requests for the application to prepare files containing Pre-authorized Withdrawal transactions for customers who have consented to pay with this method. Smartbilling will create a batch of transactions for the total amount of outstanding invoices that have become due as of the effective date for which the files are generated. These files must be manually uploaded to the Web portal belonging to the company's bank.

If the Bank provides the operator with a confirmation file (usually available between 24-48 hours after the request file was submitted), it can be imported into SmartBilling so that the successful transactions can be updated in the Accounts Receivable for each customer. The operator can select whether or not to automatically apply payments against the oldest invoices.

If not, the Operator can manually enter the confirmation status of each payment from the bank statement, or force them all to be confirmed as successful and reverse any payments that are not deposited successfully as declined payment advice notifications are received from the bank.

Payment imports

A SmartBilling payments import template can be configured if a SmartBilling customer processes payments in a separate system and wishes to import payments data into SmartBilling to reconcile subscriber billing records.

Payment applications and allocations

Without manual intervention, the system will apply payments against outstanding invoices that are due or overdue within a customer account, giving priority to the oldest outstanding invoice with the largest amount due.

In the case of payments made to a Parent Account, if automatic payment application is active, Smartbilling will search for the oldest unpaid invoices with the largest amounts due belonging to the parent account or any of the child accounts belonging to the parent account; it will apply all or part of the payment to invoices belonging to the parent account, or allocate (transfer) all or part of a payment to one or more of the child accounts and apply that allocation against the selected invoice. The process will continue with the next oldest invoices until the total amount of the payment has been applied.

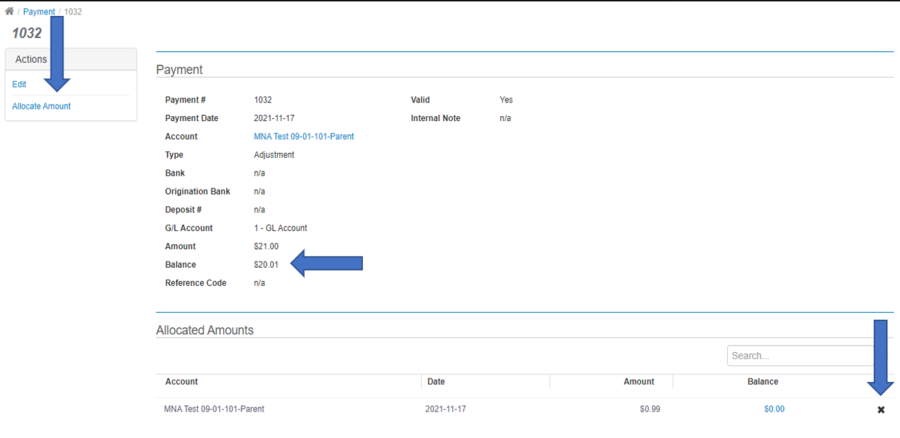

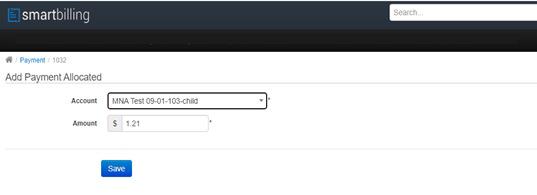

Manual allocation for parent-child accounts

A user can choose to manually allocate payment amounts between parent and child accounts. The Balance on the Payment transaction must be greater than zero. To manually allocate payments, the user must first delete the auto-allocated payments, then select the option to “Allocate Amount”. The user can then choose an allocation amount and choose which parent or child account to allocate the said amount to.

Manually applying a payment to multiple invoices

A user can choose to manually apply payment amounts if a customer has multiple invoices due. The Balance on the Payment transaction must be greater than zero. To apply payments, the user must first delete one or more payment applications, then select the option to “Apply Amount.” The user can then enter the amount and choose which invoices against which the amount should be applied.

If the account is a parent or a child account, the payment must first be allocated (either manually or automatically) between the parent and child accounts. Then, the payment can be applied manually to multiple invoices. Ensure you know the exact invoices and the payment amounts to be applied to them. For example, to manually allocate a payment to a parent account and two child accounts, all of which have multiple invoices due:

(1) Create a payment against the parent account for the full amount of the payment. The payment will auto-allocate, and the balance will be $0.00.

(2) In the Allocated Payments section, find the payment allocation and child account for which you want to manually select the invoices and amounts to be paid.

(3) Click on the blue-highlighted “Balance” amount for this allocation (it should be $0.00).

(4) On the following screen, click on the “X” icon to delete the allocation.

(5) Press the back button or go back to the payments screen. You will now see that the Balance is a positive number. A blue link called “Apply” will now also appear. Click on “Apply” and you will be see a screen with invoices for which the payment can be applied to.

(6) Repeat this for any remaining manual allocations that need to be completed.

Payments for accounts that exceed the total outstanding balance of the account

If a customer’s payment is a larger amount than their total past due amount, the remaining balance after the various payment applications and allocations will be recorded in the payment transaction as 'unapplied'.

In the example above, the customer has a $40.00 credit which resulted from an overpayment. The $40.00 in Unapplied payments is displayed. If a new invoice is posted for this account, the system will automatically apply the Unapplied amount to the new invoice and update the customer’s Invoice Balance Due accordingly.